-

AR INSURANCE INSPECTION

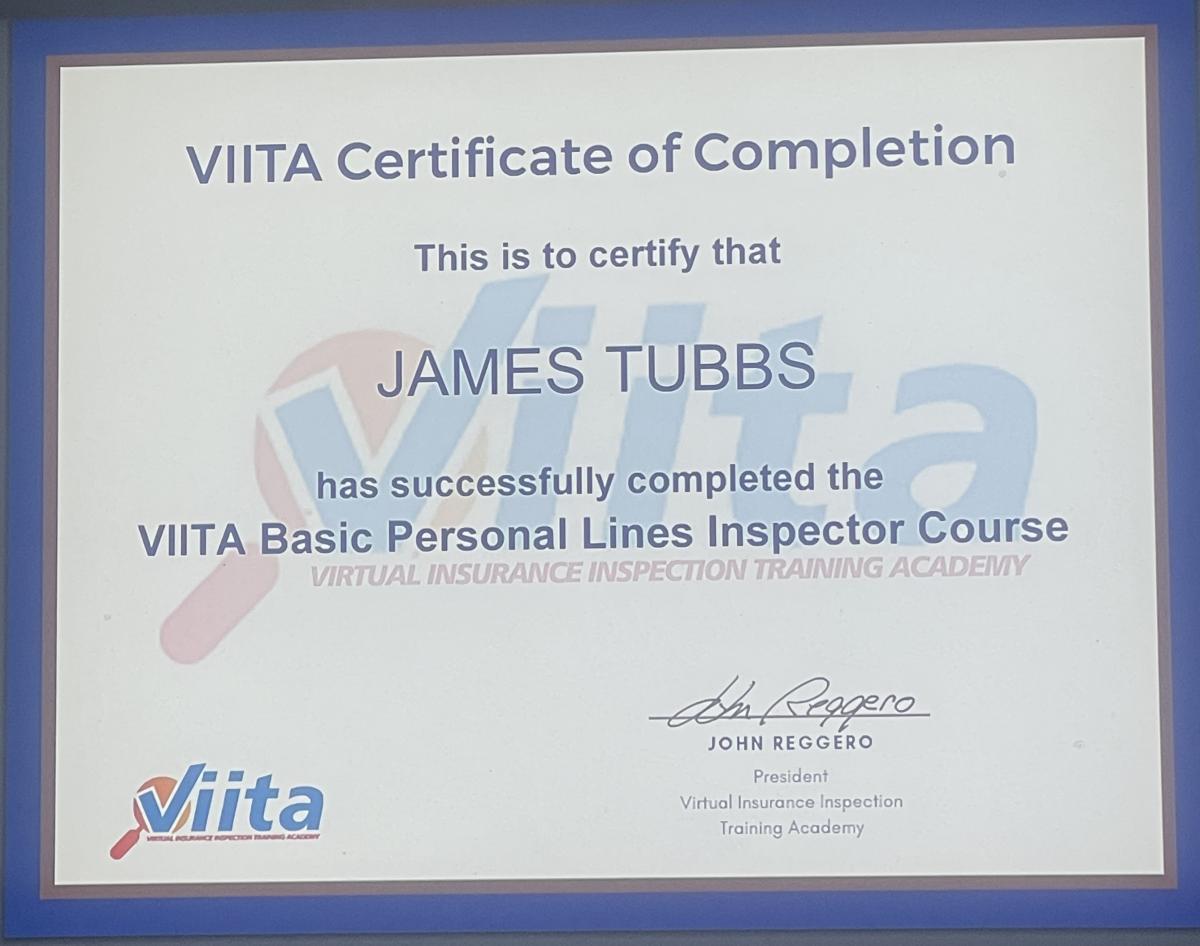

INSPECTOR

AR INSURANCE INSPECTION

INSPECTOR

AR INSURANCE INSPECTION IS A EXTENTION OF CHEROKEE HOME INSPECTION LLC, WE PROVIDE BOTH 4-POINT INSURANCE INSPECTIONS AND PRE INSURANCE INSPECTIONS. THESE SERVICES HELP ENSURE YOUR PROPERTY MEETS INSURANCE REQUIREMENTS AND CAN ASSIST IN SECURING FAVORABLE COVERAGE.

-

A 4-POINT INSPECTION INCLUDES THE FOLLOWING FOUR KEY COMPONENTS

1. ROOF: ASSESSMENT OF THE ROOF'S CONDITION, MATERIAL AGE, AND ANY SIGNS OF DAMAGE OR POTENTIAL LEAKS.

2. ELECTRICAL SYSTEMS: INSPECTION OF THE ELECTRICAL PANEL, WIRING, OUTLETS, AND SWITCHES TO ENSURE THEY MEET SAFETY STANDARDS AND ARE IN GOOD WORKING ORDER.

3. PLUMBING SYSTEM: EVALUATION OF THE PLUMBING FOR LEAKS, PIPE CONDITION, WATER HEATER STATUS, AND OVERALL FUNCTIONALITY.

4.HVAC SYSTEM: EXAMINATION OF THE HEATING,VENTILATION, AND AIR CONDITIONING SYSTEM TO VERIFY THEIR CONDITION, EFFICIENCY, AND SAFETY.

THIS TYPE OF INSPECTION IS OFTEN REQUIRED BY INSURANCE COMPANIES TO GAUGE RISKS ASSOCIATED WITH INSURING THE PROPERTY.

-

### Understanding the Importance of Pre-Insurance Inspections

In the insurance industry, the concept of risk assessment is paramount. Insurance companies must evaluate the potential risk associated with insuring a property, vehicle, or business to determine appropriate coverage and premium rates. A pre-insurance inspection, or an insurance inspection prior to renewal, is a critical step in this evaluation process. This article explores why insurance companies may require such inspections and their implications for policyholders.

#### 1. **Risk Assessment and Pricing**

One of the primary reasons insurance companies conduct pre-insurance inspections is to assess risk accurately. When a policyholder applies for coverage or renews an existing policy, the insurer seeks to understand the current condition of the insured item. For homes, this includes evaluating structural integrity, wiring, plumbing, and overall maintenance. For vehicles, it involves checking the mechanical condition, safety features, and any previous damages.

These inspections help insurers establish whether the initial pricing and coverage are still appropriate. If the inspection reveals increased risks—such as outdated electrical systems in a home or significant wear and tear in a vehicle—the insurer may adjust premiums accordingly or offer suggestions for risk mitigation.

#### 2. **Fraud Prevention**

Pre-insurance inspections also serve as a deterrent against potential fraud. When claims are filed, insurers rely on accurate representations made by policyholders at the time of policy issuance or renewal. An inspection helps verify that the property or item being insured matches the description provided.

For instance, if a policyholder claims extensive renovations were made to a property but fails to disclose them during the previous inspection, discrepancies may arise. The inspection helps ensure that any claims made are legitimate, reducing the risk of fraudulent activities.

#### 3. **Coverage Adjustment**

Insurance needs can change over time due to various factors: renovations in a home, new business ventures, or changes in vehicle usage. A pre-insurance inspection provides insurers with the necessary information to adjust coverage based on the current condition and usage of the item being insured. This ensures that policyholders are adequately covered for their specific needs and reduces the likelihood of having insufficient coverage in the event of a loss.

#### 4. **Loss Mitigation and Safety Enhancements**

Beyond risk assessment and fraud prevention, pre-insurance inspections can help identify potential hazards that policyholders may not be aware of. Insurers may recommend safety upgrades, maintenance tasks, or improvements that can mitigate risks, ultimately benefiting the policyholder.

For example, during an inspection of a business property, an insurer might identify outdated fire safety equipment or poor wiring that poses safety risks. Addressing these issues not only enhances safety but can also lower premiums in the long run, as the property is perceived to have a lower risk profile.

#### 5. **Informed Decision-Making**

Finally, pre-insurance inspections empower policyholders by providing them with clear and detailed insights into the condition of their properties or vehicles. This information helps them make informed decisions not only regarding insurance coverage but also about maintenance and improvements.

When policyholders are aware of existing risks or necessary upgrades, they can take proactive steps to protect their investments, potentially saving money on claims and premiums over time.

#### Conclusion

In summary, pre-insurance inspections are a vital tool for insurance companies to evaluate risk, prevent fraud, adjust coverage, facilitate loss mitigation, and empower policyholders. By understanding the importance of these inspections, policyholders can better appreciate the role they play in the insurance process, leading to more informed choices and ultimately, enhanced protection for their assets. Whether applying for new coverage or renewing an existing policy, being prepared for an inspection can lead to a smoother and more beneficial insurance experience.

Serving Cherokee Village, Hardy, Ash Flat, Evening Shade, Cave City, and surrounding area.